AutoFib Liquidity Sweep v1

This strategy generates signal alerts when price taps the 0.5, 0.618, or 0.764 levels of an H1 AutoFib zone. It’s built for traders who understand structure, liquidity, and clean price action.

Not every signal is a trade — this tool is designed to support discretionary decision-making based on solid technical context.

Symbols:

Forex Majors / High-Liquidity Pairs (e.g. GBPUSD

EURUSD

GBPJPY)

Created 02 May 25

Modified 02 May 25 15:28

Header

General Forex Majors / High-Liquidity Pairs (e.g. GBPUSD EURUSD GBPJPY)

AutoFib Liquidity Sweep v1

This strategy generates signal alerts when price taps the 0.5, 0.618, or 0.764 levels of an H1 AutoFib zone. It’s built for traders who understand structure, liquidity, and clean price action.

Not every signal is a trade — this tool is designed to support discretionary decision-making based on solid technical context.

The Trading Jackal

🐺 The Trading Jackal Method

1. Wait for AutoFib signal on 15M or 1H chart

2. Drop to 1M/5M – wait for liquidity sweep + CHoCH

3. Enter on return to refined OB/FVG or strong wick rejection

4. SL just past the sweep; TP at structure or next Fib zone

💡 Avoid chop – trade clean, trending setups with clear intent

🧠 Discipline matters. This strategy works best for those who can read price and filter out low-probability setups.

Not every signal is tradable — stay sharp.

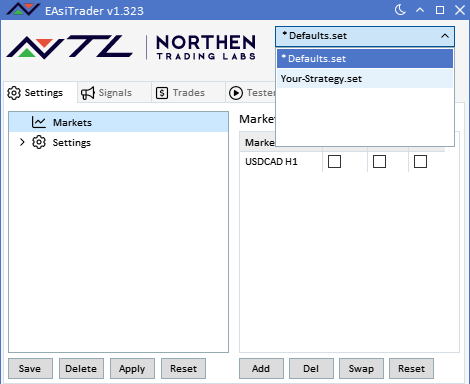

SMC AutoFib 1hr 4hr.set

Forex Majors / High-Liquidity Pairs (e.g. GBPUSD, EURUSD, GBPJPY)

Scripts

(LowerWickX(1, FibPrice('AutoFib1', 0.5)) || LowerWickX(1, FibPrice('AutoFib1', 0.61)) || LowerWickX(1, FibPrice('AutoFib1', 0.76))) && Signal('AutoFib1') == Bullish && BarSize(1,3) > BarSize(1,1) * VAR2 && LowBars(VAR3) < 2 && HH(VAR5) >= (Ask() + ATR1() * VAR4) ? Ask() : 0

Close(1) - (ATR1(1) * VAR0)

OrderPrice() + (VAR1 * Point)

(UpperWickX(1, FibPrice('AutoFib1', 0.5)) || UpperWickX(1, FibPrice('AutoFib1', 0.61)) || UpperWickX(1, FibPrice('AutoFib1', 0.76))) && Signal('AutoFib1') == Bearish && BarSize(1,2) > BarSize(1,1) * VAR2 && HighBars(VAR3) < 2 && LL(VAR5) <= (Bid() - (ATR1() * VAR4))? Bid() : 0

Close(1) + (ATR1(1) * VAR0)

OrderPrice() - (VAR1 * Point)

Position Management

0

12345678

Trading Rules

false

1

0

Time Management

true

Stop Management

0

0

false

Exit Management

3

3

false

Custom Indicators

+NTL\ATR(1,14).ex5,0

+NTL\AutoFib(:H4,1,'','0.0,0.236,0.382,0.5,0.618,0.762,1.0',10,0,4,50,90,0,1.2,20,250,150,'0.5,1',0,0,3).ex5,0,1,2,3,4,5

User Variables

5;1,2,3,4,5,6,7,8,9,10

200;100,200,300,400,500,600,700,800,900,1000

0.2;0.2

5;5

1;1

10;10

Backtesting & Optimisation

0

100000.00

0

0

100

1

16

1

16

4

0

0

1000.00;0.00

StatType_TotalProfit

0.00;0.20

StatType_Drawdown

0.40;0.00

StatType_WinRate

Debugging

72

Other

13

Interface

2

16777215

3487231

65280

16776960

16777215

16777215

1