Full Auto Fibonacci Retracement Strategy

This strategy leverages Fibonacci retracement levels for trading major and minor currency pairs. While optimized for the 1-hour timeframe, it focuses on capturing high-probability retracement trades with emphasis on optimal profit targets.

Buy Trades: Only considered when:

-Price shows bullish reaction at Fibonacci level

-Market structure supports upward movement

-Key retracement levels align with potential reversal

Sell Trades: Only considered when:

-Price shows bearish reaction at Fibonacci level

-Market structure supports downward movement

-Key retracement levels align with potential reversal

Alerts or Live Trading

You can select either:

-Live Mode: Executes trades automatically

-Alerts Mode: Sends alerts when trade criteria are met

Optimization Tip

-For automated trading, optimize profit targets and drawdown parameters in the Tester tab before running live.

Manual Trading Option

Manual traders can enhance performance by:

-Adjusting take-profit levels based on market structure.

-Identifying 'likely price targets' for better exits.

-Fine-tuning entries at key Fibonacci levels.

Risk Disclaimer

Trading involves inherent risks, and no strategy guarantees success. Always perform thorough testing before live deployment.

General Major Pairs Minor Pairs H1

Full Auto Fibonacci Retracement Strategy

This strategy leverages Fibonacci retracement levels for trading major and minor currency pairs. While optimized for the 1-hour timeframe, it focuses on capturing high-probability retracement trades with emphasis on optimal profit targets.

Buy Trades: Only considered when:

-Price shows bullish reaction at Fibonacci level

-Market structure supports upward movement

-Key retracement levels align with potential reversal

Sell Trades: Only considered when:

-Price shows bearish reaction at Fibonacci level

-Market structure supports downward movement

-Key retracement levels align with potential reversal

Alerts or Live Trading

You can select either:

-Live Mode: Executes trades automatically

-Alerts Mode: Sends alerts when trade criteria are met

Optimization Tip

-For automated trading, optimize profit targets and drawdown parameters in the Tester tab before running live.

Manual Trading Option

Manual traders can enhance performance by:

-Adjusting take-profit levels based on market structure.

-Identifying 'likely price targets' for better exits.

-Fine-tuning entries at key Fibonacci levels.

Risk Disclaimer

Trading involves inherent risks, and no strategy guarantees success. Always perform thorough testing before live deployment.

Sam Northen

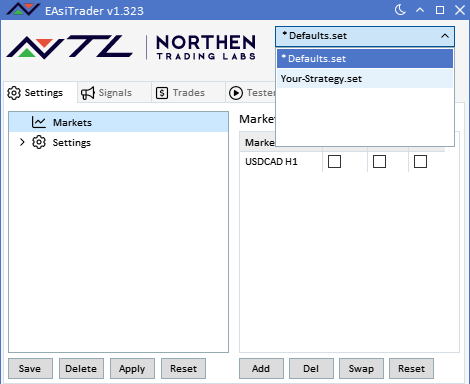

NTL-FibonacciRetracement.set

Major Pairs, Minor Pairs, H1

Signal('AutoFib1') == Bullish && Ask() > FibPrice('AutoFib1',0.762) && Low() <= LL(15) && Ask() < HH(10) ? Ask() : 0

Ask() - (ATR1() * VAR0)

Signal('AutoFib1') == Bearish && FibPrice('AutoFib1',0.762) > Bid() && High() >= HH(15) && Bid() > LL(10) ? Bid() : 0

Bid() + (ATR1() * VAR0)

4.00

1.00

false

+NTL\ATR(1,14).ex5

+NTL\AutoFib(1,'','0.0,0.236,0.382,0.5,0.618,0.762,1.0',10,0,4,50,100,0,1.2,20,40,150,'0.618,0.762',0,0).ex5,0,1,2,3,4,5

6;1,2,3,4,5,6,7,8,9,10

100000.00

13

1

0

1

0

4

65280

16776960