HLines Support/Resistance Strategy

A strategy that trades bounces from HLine support and resistance levels. Long entries when price is above a newly spawned HLine, short entries when price is below. HLine pivot string used is S2,R2;R2,S2. This means that each HLine that has been calculated has acted as support AND resistance in the past. This is to improve the overall structure of the market when trades are entered.

Symbols:

GBPUSD H1

Created 29 Dec 24

Header

General GBPUSD H1

HLines Support/Resistance Strategy

A strategy that trades bounces from HLine support and resistance levels. Long entries when price is above a newly spawned HLine, short entries when price is below. HLine pivot string used is S2,R2;R2,S2. This means that each HLine that has been calculated has acted as support AND resistance in the past. This is to improve the overall structure of the market when trades are entered.

AI

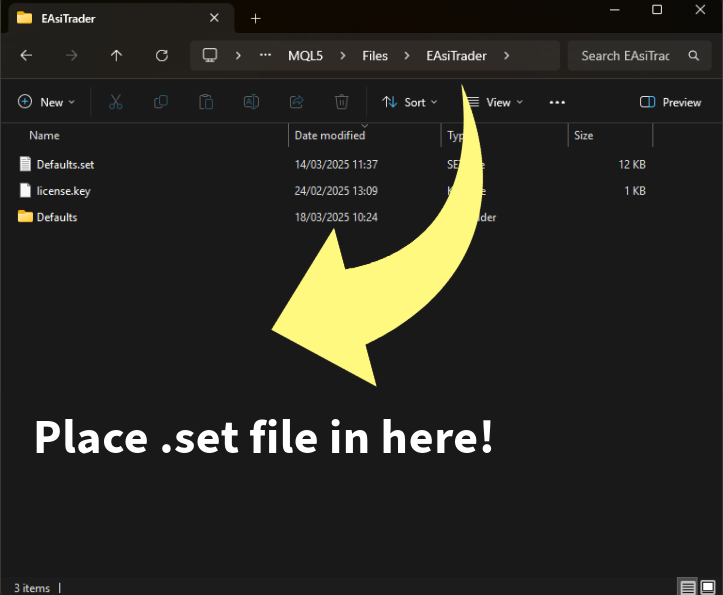

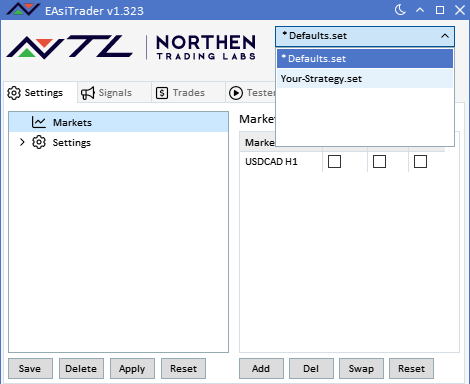

hlines-strategy.set

GBPUSD H1

true

Claude

Scripts

Signal('HLines1') > 0 && Open(1) > HLines1(1,0) && Close(1) > HLines1(1,0) ? Ask() : 0

Ask() - (ATR1(1) * VAR0)

OrderPrice() + (VAR1 * Point)

Signal('HLines1') > 0 && Open(1) < HLines1(1,0) && Close(1) < HLines1(1,0) ? Bid() : 0

Bid() + (ATR1(1) * VAR0)

OrderPrice() - (VAR1 * Point)

Exit Management

false

Custom Indicators

+NTL\ATR(1,14).ex5,0

+NTL\HLines(1,'',480,64,'S2,R2;R2,S2',15,0,0.3,100).ex5,0,1

User Variables

5;1,2,3,4,5,6,7,8,9,10

500;100,200,300,400,500,600,700,800,900,1000,1100,1200,1300,1400,1500

Backtesting & Optimisation

100000.00

13

1

PerformanceMetric_Balance

0

PerformanceMetric_None

1

PerformanceMetric_Balance

0

PerformanceMetric_None

4

Interface

65280

clrLime

16776960

clrAqua